Freelance in the Philippines

There has been a huge shift in Filipinos preferring to work as freelancers rather than working for a company in an office. Ever since the pandemic, more people are shifting to remote work, which usually is freelance work. In the Philippine economy, the freelancer's market growth went up by 35% in 2022. Proving that freelancers' value is increasing through the years.

More Filipinos prefer remote work to be able to spend more time with their families and have control over their schedules. As freelance workers have the freedom to work during their hours and be able to have that work-life balance.

Being able to handle the amount of work they choose to take on. Freelance workers can take care of their mental health to make sure they don’t overwork themselves. Last May 2022 a survey on mental wellness was conducted by Rakuten Insight that showed 63 percent of respondents in the Philippines have felt more stressed or anxious in the past 12 months. It was also revealed in the same survey that Filipinos preferred to improve their sleep and exercise regularly.

Who is considered a Freelancer?

A Freelancer is someone who works independently. They are not tied to a long-term contract. Usually, they work per project which frees them up to manage their time and client base.

But you can also see freelancers using an agency to get connected to clients around the world that seek their skills.

Freelancers are like small business owners. Whether you have set up your own business or outsourced your skills, you must have to pay freelance taxes. Freelance services may fall under different categories.

Here are the different professional types of freelancers:

|

While there are those what we call single or sole proprietor

|

The key difference here is that Mayor’s Permit or Barangay Clearance is not required for freelancers.

Registering your freelance job in the Philippines

All working citizens and residents are obligated to pay taxes in the Philippines. Tax evasion is a serious crime and could be charged up to two to four years imprisonment. As well as fines, interest, and compromise fees which would sum up to be higher than the original tax due.

But there are also those exempted from freelance taxes. For example, those who are considered non-resident aliens, meaning they do not have citizenship or live in the Philippines.

When you leave the country for any reason, you won’t be required to pay taxes during that time period you were out. You may also be exempted if you’re earning 250,000 pesos or less annually.

If you don’t fall into any of these situations then you must pay your taxes.

So how do you register in BIR as a freelancer in the Philippines?

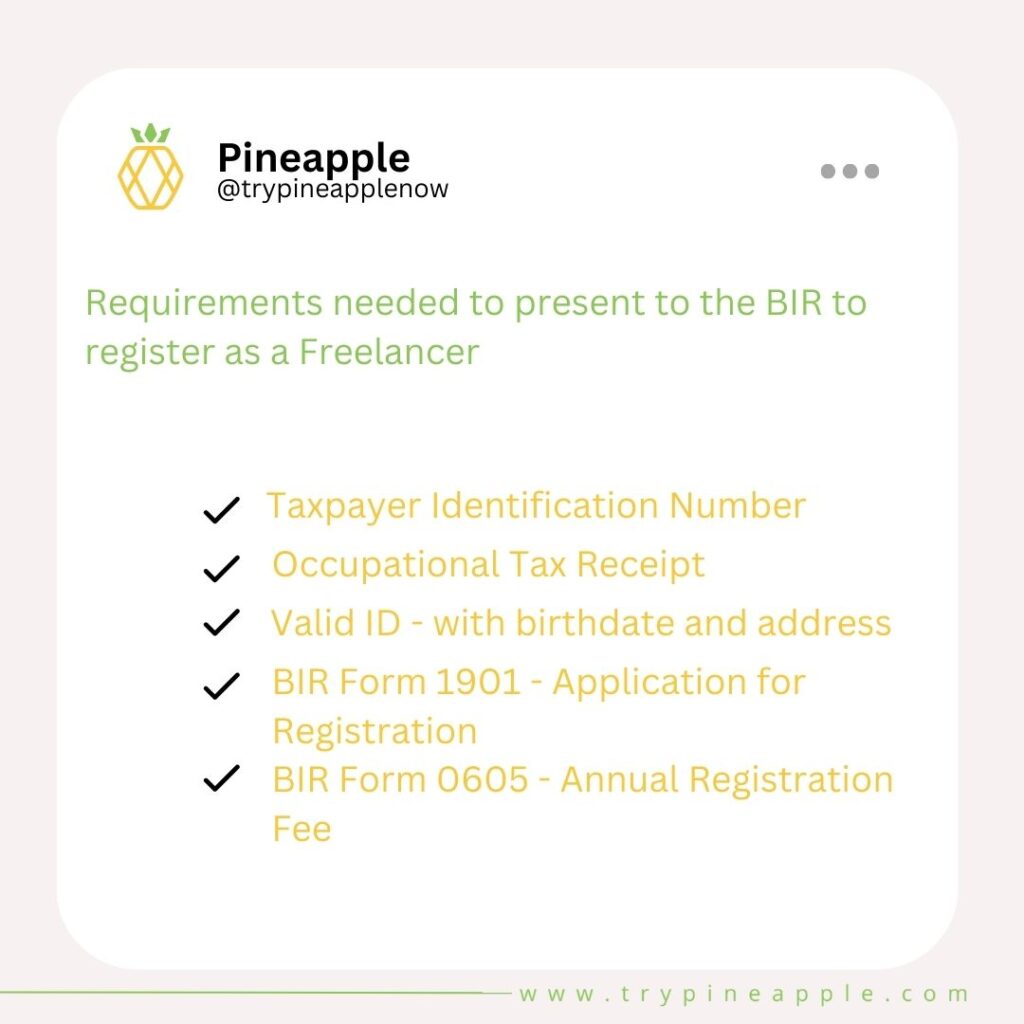

It’s never too late to start paying taxes. Here’s a quick guide to getting started. The following are requirements that you would need to have ready to be able to register for BIR as a freelancer.

1. Taxpayer Identification Number.

- Usually, you have this before working

2. Occupational Tax Receipt

- You can get this in your Municipality Hall. Just bring a Valid ID and pay the fees of 200 pesos to 450 pesos, depending on the Municipality. Some Municipal do not give OTR, so just skip this

3. Valid ID - with birthdate and address

- Make sure your current address is the same as the one on your valid ID.

- This includes your passport, driver's license, national ID, or barangay certificate. You could also bring your electricity

4. BIR Form 1901 - Application for Registration

- Print in 2 Copies and sign form

5. BIR Form 0605 - Annual Registration Fee

- An annual fee of 500 pesos will be paid when submitted with this form

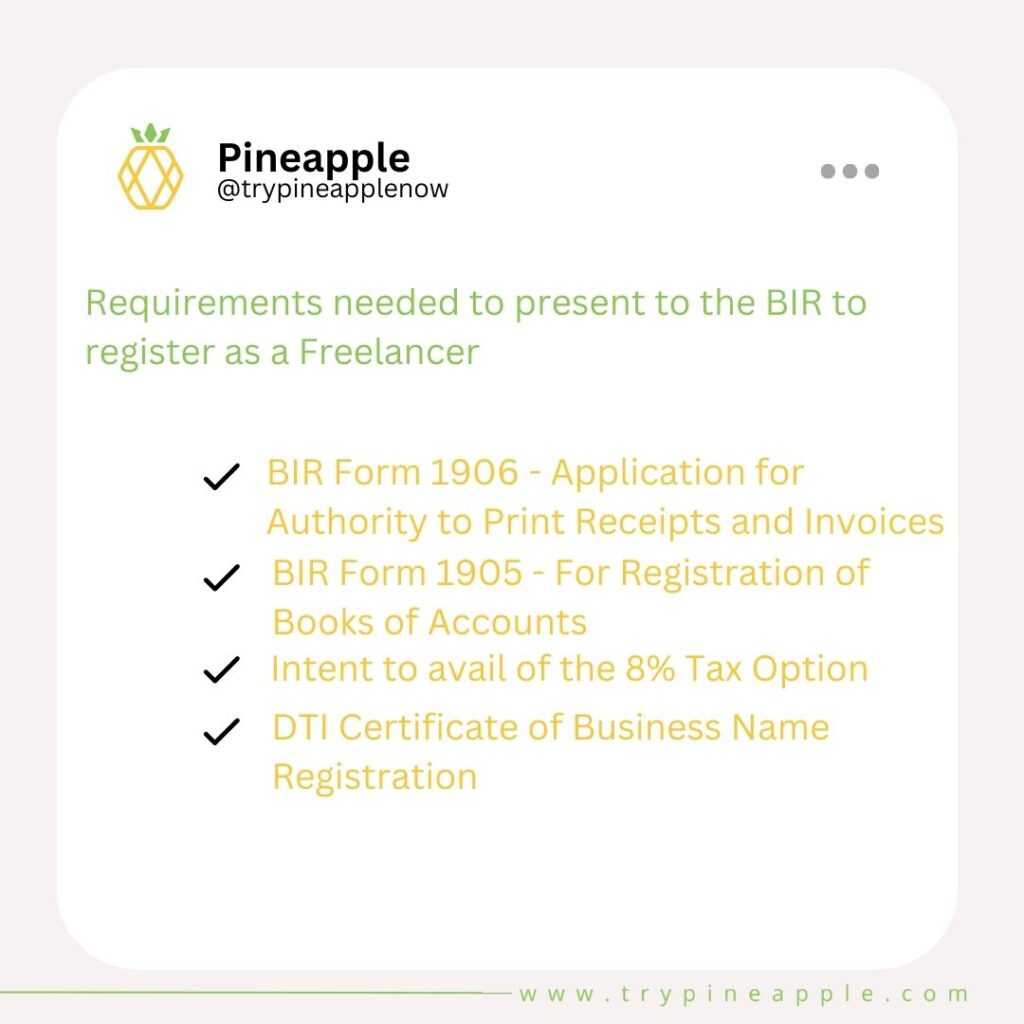

6. BIR Form 1906 - Application for Authority to Print Receipts and Invoices

- This form is to be accomplished by all taxpayers every time printing of receipts and invoices is needed.

7. BIR Form 1905 - For Registration of Books of Accounts

- This form is to be accomplished by all taxpayers who intend to update/change any data or information, or a replacement of lost TIN Card/ Certificate of Registration.

- To be filed whether Head Office or branch.

8. Intent to avail of the 8% Tax Option

- Bring one copy of a letter with this template

9. DTI Certificate of Business Name Registration

- DTI is for loan and branding purposes which is optional. You have ownership of that name throughout the country and no one else can use it. Some loan providers may ask for a DTI Certificate of Registration so it is recommended that you get one. You can do it online and pay through GCash.

- Certificate will be sent in PDF. https://bnrs.dti.gov.ph/registration

10. If you hire a professional to do all this it could sum up to 3,000+ or with DTI it could cost 5,000+

Once you’ve completed all these requirements and submitted it to the BIR you are now registered. Congratulations!

Register in BIR Now

There are a lot of benefits to being a freelancer. Don’t miss out on this chance to work with flexible hours while being well compensated. Simply just prepare the requirements above and you can easily have yourself registered in no time.

Working freelance is a very rewarding experience that gives you the opportunity to spend more time with your family and friends.

So if you’ve been thinking about working as a freelancer online, you can read how to start out as a virtual assistant here.

Pineapple is always looking for Filipino professionals who want to share their skills with clients abroad. Just drop by our career page now and we can’t wait to work with you!