One of the most exciting opportunities for virtual assistants lies in the bookkeeping industry. With an estimated 1.7 million bookkeepers in the US alone.

Not only is it a fantastic career packed full of variety, but it also pays well with an average salary of $42,000. You may, however, be wondering if you have the bookkeeping virtual assistant skills to succeed.

What Does a Bookkeeping Virtual Assistant Do?

To fully understand the skills required to be a bookkeeping virtual assistant, it’s a good idea to start by looking at what the role involves. A bookkeeper is a crucial addition to any business, and a good bookkeeper is even better. Located in the world of accounting, a bookkeeper is responsible for monitoring and reporting on the financial health of a business. Therefore, number crunching and ensuring that cash flows smoothly in and out of the business is at the heart of bookkeeping. And it’s important you know how to do this as a virtual bookkeeper.

What are the Bookkeeping Virtual Assistant Skills You Need?

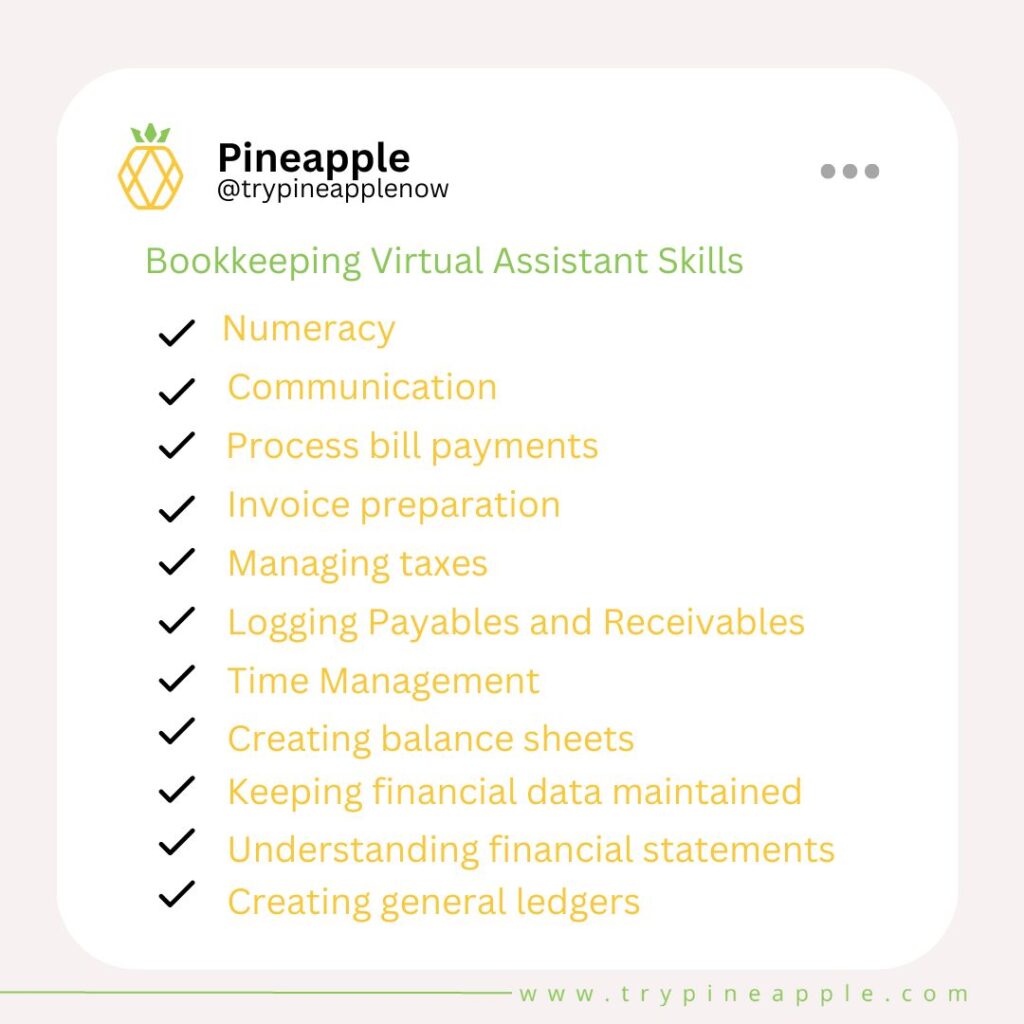

Handling the accounts of any organization is a big responsibility. So it’s not a position that just anyone can take on. You need to make sure you’re a detail-orientated individual with high levels of motivation. It’s also important that you come fully loaded with all the necessary bookkeeping virtual assistant skills such as:

Numeracy:

Basic math skills and numeracy are the most fundamental skills required to succeed as a bookkeeper. Almost all the daily tasks you take on will involve calculating figures and comprehending how these affect the finances of an organization. Naturally, you will have access to a calculator, but you need to fully understand the basics of math to be confident in processing figures.

Communication:

One of the best skills to have on your side as a virtual bookkeeper is the ability to communicate effectively. Working in an accounts department, you will regularly be communicating with all the other teams in the business. This means that you will be dealing with a wide range of people in different roles. The key to success in this scenario is having the knowledge to tailor your communication to each person you speak with as, remember, there’s no room to be unclear when it comes to discussing finances.

Process bill payments:

One of the most important elements of good business is paying your bills on time. However, it’s very easy for billing processes to fall by the wayside in the pursuit of turnover. This, of course, can soon cause problems with vendors and lead to supply issues. Thankfully, a good virtual bookkeeper assistant will remedy this with excellent organizational skills and an understanding of how to make payments. So, by harnessing the power of calendar reminders and prioritizing your workload, you can prevent bills piling up.

Invoice preparation:

Along with processing bills, invoice preparation is an essential skill for any virtual bookkeeping assistant. Busy business owners, after all, do not have the time to dedicate to preparing invoices as their skills are needed elsewhere in the organization. But this is where you can step up as a virtual assistant. It’s a detail-focused skill. One which involves handling quantities, product data, prices and customer account details. Being able to plan your time here is also vital, as you will often be taking on bulk invoice runs.

Managing taxes:

A necessary evil of all businesses is dealing with taxes, but it’s also an essential task. Which allows a business to stay the right side of the law and avoid financial penalties. Unfortunately, most business owners struggle to understand the complexities of tax calculation. A virtual bookkeeper will be well-trained in the workings of the tax system and be able to calculate every last cent which needs taxing. As such, being able to handle the intricacies of taxes is a critical skill for all bookkeepers.

Logging Payables and Receivables:

It’s important to have an idea of where the money within a business is at any given moment. And this is why being able to log payables and receivables is such an important skill to grasp. However, this can be a time consuming and challenging task to take on, and many business owners simply don’t have the skills required to complete it. So, who do they turn to when they need to track the funds owed to their business and any funds they may owe? That’s right, a virtual bookkeeper, as they should be able to handle this effortlessly.

Time Management:

Deadlines play a major role in bookkeeping, so being able to manage your time effectively is paramount. There’s never a quiet period in accounting and, as a result, having the skills to structure your time in the most effective mannner is a real necessity. With a conscientious approach to time management, you will find that you will be able to maximize your productivity and provide financial reports and information when your employer needs them.

Creating balance sheets:

A good set of bookkeeping virtual assistant skills will allow you to tackle one of the most challenging aspects of finance: balance sheets. Without an accurate balance sheet in place, a business simply can’t operate effectively. These documents detail the total worth of a business. In terms of assets and detail how this is distributed against income and expenditure. Naturally, being confident with numbers will pay dividends in this area and ensure business owners can monitor the financial health of their organization.

Keeping financial data maintained:

Financial data is all about the figures, and these figures need to be detailed accurately. Thankfully, business owners have taken advantage of accounting software which takes the pain out of accounting and makes processes much easier. These databases will keep an accurate log of the company’s financial status and help you take taxes into account. Accordingly, it’s crucial you’re proficient with data inputting and handling financial software. As long as you have this on your side, you should have no problems when it comes to bookkeeping.

Understanding financial statements:

The accounting world is a complex one, and the associated financial statements take this complexity to new levels. Few people, outside of the accounting industry, will be able to decipher exactly what a financial statement means, but every organization needs someone on board who can. As a virtual bookkeeper, however, you should have the knowledge and experience to quickly translate a financial statement. It’s one of the most valuable bookkeeping virtual assistant skills and will allow you to advise on the businesses earning potential and financial well-being.

Creating general ledgers:

Any virtual bookkeeper who is worth their wages will have no problem in creating and maintaining a general ledger. A record of all the ongoing financial transactions within a business. A general ledger is of high importance as it is used as a reference point for almost all other financial records. Therefore, attention to detail and an ability to handle large amounts of data are highly desirable skills when it comes to working with a general ledger.

Chasing Payments:

Not all customers like to pay their bills on time, and this can have a major impact on the financial health of a business. It may not be the most comfortable task in business, but chasing payments is absolutely necessary. Having the confidence to contact non-payers, sometimes on multiple occasions, and discuss outstanding payments is paramount. For a business owner, having a bookkeeping assistant to complete this groundwork is a huge time saver.

Reconciling financial records:

Reconciliation is the process of comparing financial transactions to existing financial documentation, and it’s a critical job. Not carried out correctly, reconciliation can not only provide a distorted view of an organization’s financial health, but also cause legal issues. Accordingly, it’s a necessity of bookkeeping. Thankfully, experience in reconciling financial records and bank statements will give you the confidence to tackle this with ease.

Integrity:

Finally, a good virtual bookkeeper should pride themselves on their integrity. Due to the nature of the data you are handling, you need to remain professional. Be transparent when working with financial records. It’s a role with high levels of responsibility. And one where, if you fail to protect the financial integrity of an organization, all manner of legal and financial penalties could suddenly come knocking at the business owner’s door. Consequently, making sure you always adhere to both internal and external financial policies is essential.

Final Thoughts

Equipping yourself with the best bookkeeping virtual assistant skills is a surefire way to kickstart your career. The skills required may be numerous. But many of these will already be in-built. If you have prior experience in bookkeeping, you will almost certainly be ready to take on this challenge.

But how do you get started in the world of virtual bookkeeping? Luckily, you don’t have to look much further than Pineapple. With a proven history of connecting business owners with amazing virtual assistants. We can take the pain out of your job search. So, if you want to get started as a virtual bookkeeper, get in touch with us now!